- Company maintains its target of reaching 1.8GW operational by the end of 2023, which means almost tripling its installed capacity since its IPO.

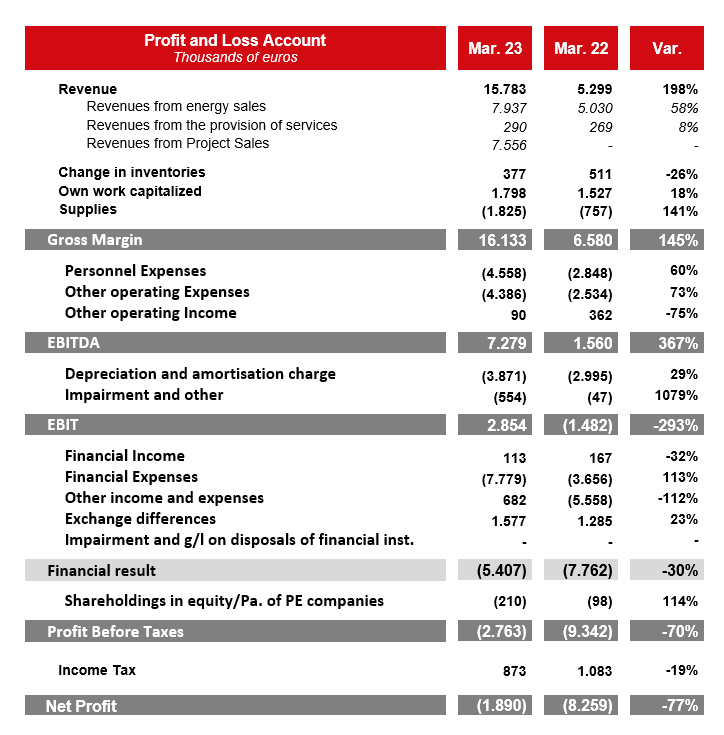

- Total revenues reached 15.8 million euros, 198% more than in the first quarter of 2022, and EBITDA increased 4.7 times to 7.3 million euros.

- In addition to the 904MW in operation, the company adds 951MW under construction and, in the last quarter, increases its pipeline by 1.3GW, reaching 12.7GW.

Madrid, 29 May 2023.- Opdenergy, an independent producer of renewable energy (IPP), presents to the CNMV the financial results corresponding to the first quarter of 2023 with solid financial and operational figures, much higher than those published in the same period of the previous year. Opdenergy, the only company to achieve its listing on the Continuous Market in 2022, continues to meet the targets set on July 22 in its debut on the Spanish Stock Market.

Opdenergy closed the first quarter of 2023 with a 198% increase in revenues, which reached 15.8 million euros. On the other hand, the renewable energy firm has achieved an EBITDA of 7.3 million euros, which is 4.7 times the figure published in the first quarter of last year. This growth is the result of the consolidation of its IPP business and the Bruc transaction, which continues to progress as planned after the transfer of assets was completed on May the 11th.

Opdenergy’s global portfolio of renewable assets increased by 1.3GW in the first quarter of 2023 to 15.1GW and will support the company’s future growth. Of this 15.1GW, 59% is in Europe, 25% in the USA and 16% in Latin America. In terms of technologies, 61% is photovoltaic, 18% is wind and 21% is storage.

Luis Cid, CEO of Opdenergy, assures: “After our debut on the Continuous Market a few months ago, we continue to make progress with first quarter figures showing clear growth and bringing in these last three months 225MW into operation. The strength of these figures, together with the recent asset transfer to Bruc, underpins our business model as a multi-technology, multi-country growth company. Opdenergy shows the consistency of its strategy in this current context where renewable energies are more necessary than ever”.

MOST RELEVANT OPERATIONAL PROGRESS FACTS

Bruc transaction

The annual results are supported by the transfer of different photovoltaic solar energy projects to Bruc Energy, following the agreement signed with this company in August 2021, which includes the sale of 1.1GW of projects in different parts of Spain that are transferred as these assets obtain certain permits, the most relevant being the environmental permit. As of the date of this press release, Opdenergy has transferred 100% of the assets to Bruc.

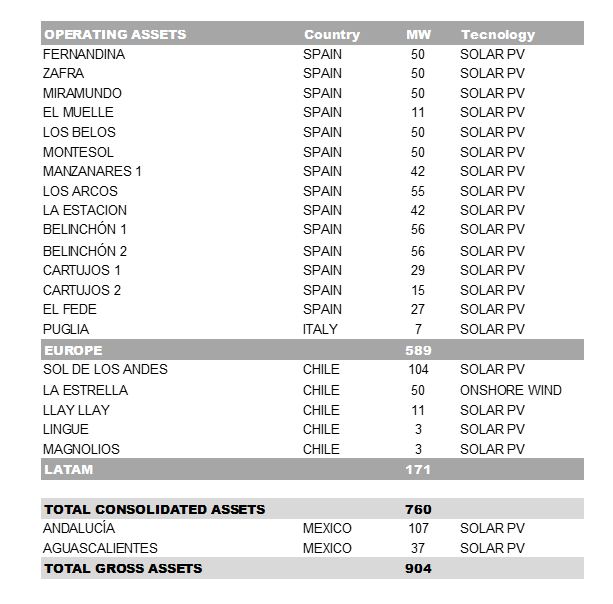

Spain

As of the date of this publication, Opdenergy has completed the construction of six projects: La Estación of 42MW, Belinchón 1 of 56MW, Belinchón 2 of 56MW, Cartujos 1 of 29MW, Cartujos 2 of 15MW and El Fede of 27MW, all of them being solar PV plants. A total of 225MW. These projects will prevent emissions of more than 67,000 tonnes of CO2 into the atmosphere per year, equivalent to the consumption of more than 134,000 homes. With these projects, the energy company has 581MW in operation only in Spain.

Strength of the international business

In the US, Opdenergy continues the construction works of its Elizabeth project in Louisiana (160 MW) and High Horizons in West Virginia (100 MW), signing an addendum to the latter’s PPA.

In Italy, the company is also continuing construction of the 24MW La Francesca plant, which will be added to the 7MW already in operation in the country.

Procurement of AAPs

Another important milestone reached by Opdenergy in this first quarter has been the obtention of Prior Administrative Authorizations in Spain for a total of 2,320MW, of which 320MWs correspond to projects already built; 667MW, to projects under construction; 1,101MW, to projects for the asset sale agreement with Bruc (thus obtaining all the PSAs within the sale agreement for these assets); and 231MW, to projects that the company will put under construction throughout 2023.

ESG

Opdenergy has published its 2022 sustainability report this quarter, where it analyzes its progress in environmental, social and good governance matters. Among them, it stands out having obtained an ESG Rating with MSCI with an “unsolicited” score of A.

About Opdenergy

Opdenergy is an independent renewable energy producer, or IPP, operating in Europe, the United States and Latin America with more than 17 years of experience. The company develops, builds, finances, manages and operates high quality renewable energy projects in several countries. Opdenergy has a portfolio of 1.9GW of assets under operation and construction in which 70% of the energy is contracted under long-term PPAs. In addition, Opdenergy has an additional portfolio of projects in different stages of development of 12.7 GW that support its growth strategy.

Opdenergy plays an important role in the decarbonization of energy in the different countries in which it operates. It is present and has projects in the pipeline in five European markets (Spain, Italy, United Kingdom, France and Poland), in the United States and in three Latin American markets (Chile, Mexico and Colombia).

Opdenergy is listed on the Spanish continuous market (BME:OPDE).